The uncomfortable truth about understanding

At Fidelity we’re very proud of our communication programmes as we know that engagement is the critical first step to help members make smart financial choices for their future. But we’ve recently had to face up to an uncomfortable truth.

Extensive external research, alongside our own internal testing, shows that many people struggle to fully understand financial communications — even when they believe they do. Like much of our industry, we’ve often assumed that what’s familiar to us is understandable to everyone else. It isn’t. The reality is quite the opposite, literacy and numeracy challenges are far more widespread across the UK than most of us realise.

Around one in six adults has extremely low literacy.

At least one in five experiences maths anxiety.

And almost half of adults have numeracy skills no higher than those expected of a primary school child. This isn’t a new problem. As far back as 2015, the FCA recognised that poor numeracy affected around 20m people in the UK - the single biggest consumer vulnerability.

The most concerning insight? There is often a significant gap between what people think they understand and what they really do. In pensions and long-term savings, that gap matters. It leads to disengagement, loss of confidence, and ultimately poorer financial outcomes. Research has shown that members were far more likely to put communications in the ‘too hard’ basket and ignore it to their detriment.

Going beyond regulatory requirements

At the same time, the FCA’s Consumer Duty, introduced in July 2023, raised the bar for our industry. It puts the onus on firms to ensure customers understand our communications well enough to act with confidence in their own best interests.

This was an opportunity disguised as a compliance challenge, and it became a chance to rethink how we communicate and improve our competitive offering. From a business perspective, we also recognised that by helping our members feel confident they understood us, we were more likely to earn their trust, in turn leading to engagement. A clear case of doing the right thing for members, and the smart thing for the business.

We wanted to put accessibility and behavioural science at the centre, and to define what customer-first communications really means for our members. To support this, we knew it was important to work with recognised industry experts who could both advise and hold us to the highest possible standards of clarity and understanding.

In 2023 we started working with our chosen accessibility partners Boring Money, Plain Numbers and Fairer Finance on our highest impact journeys.

We have over 300 communications where choices need to be made, and misunderstanding or inaction could lead to customer detriment. Think of welcome letters, retirement quote and wake-up packs, and pension transfers.

We started by using a combination of in-person and online member panels, in-house training of our own copywriters and deep dive reviews to establish a set of principles and practices across design and language. This approach was recognised by our industry peers with Best Implementation of Consumer Duty at the 2024 Financial Services Forum Awards.

From principles to a system - introducing Format for All

From a dedicated team working on specific reviews, the next challenge was ensuring our accessibility standards could be scaled across the business.

Incremental improvements wouldn’t be enough. What we needed was a shared standard, something that would change how we communicate, everywhere, every time.

We created the Customer-First Communications Framework with behavioural science experts Cowry Consulting. A set of language, comms design and structure principles based on how people think and react to receiving financial information – Format For All.

Format for All combines:

Accessible language principles to say things in plain English

Accessible numeracy to help people truly understand numbers, not fear them

Behavioural science to support decision-making rather than overwhelm it.

The result is a comprehensive framework that sets a consistent approach to how we communicate. It means members can move across their entire relationship with Fidelity with clarity and the confidence to make smart choices. Every standard in our 35-point checklist and best practice guide is supported by published research that you can read up on in our Science Behind The Science booklet.

It also addresses a real historical challenge. Previously, communications could vary in tone, format and complexity, even within the same journey. That inconsistency could create a poor experience for customers — and, in some cases, the risk of negative outcomes due to misunderstanding.

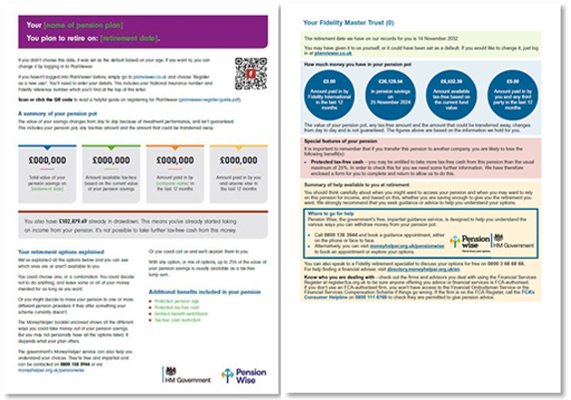

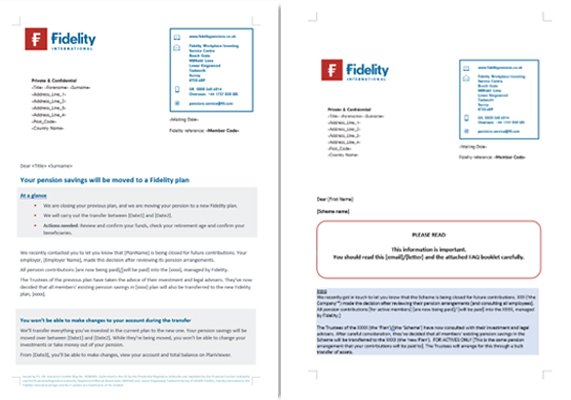

Our systematic approach with Format for All changes that for good. You can see in the before and after examples below how we’re making it easier for members to scan our communications and quickly grasp what we’re saying and what they need to do.

What changed when understanding came first

The impact has been both measurable and meaningful. Our Format for All principles were awarded a gold ribbon from Fairer Finance in December 2025. We were placed first in their customer experience ratings for clear improvements in clarity, confidence and comprehension. Members engage more easily, understand their options better, and feel more confident about the decisions they are being asked to make.

Now that Format for All is live within our content creation processes, the next step is scale.

We’re rolling out our new and improved communications for testing, while ensuring all design elements work seamlessly with existing communications management systems. We have also embedded the Format for All principles into our AI Marketing Intelligence Content Engine (MICE). MICE is the first tool used by copywriters to check they adhere to Format for All standards, meaning accessibility is built in from the start rather than added at the end. It ensures what we’re saying is consistent and comprehensible across all our modes of communication.