FutureWise has included private assets in its one-and-only default strategy since the beginning of 2025, focusing on diversified but specialist implementation. Many Long Term Asset Funds (LTAFs) have adopted vastly differing approaches to meeting the needs of Defined Contribution (DC) schemes, and through extensive research Fidelity has identified key dynamics to improving member outcomes.

Fidelity’s approach leverages the experience of the most sophisticated private asset solutions globally (Australia, Canada, US and South Africa) to identify solutions with the best risk return profile for DC pension investors. We believe the critical design principles for any private market investor should be:

- Maximising the investment universe

It is essential that any selection process focusing on better returns must start with a wide universe, being careful to minimise constraining factors wherever possible. When building our Fidelity Diversified Private Asset LTAF, we were mindful of:

- The UK private market only being £1.2 trillion of $15.5 trillion (i.e. around 10%), according to the FCA at the end of 2024.

- Less than 20% of 25,000 private asset strategies open to investment today are evergreen, according to Prequin. With the average track record very limited in comparison to the closed ended universe.

Additionally a focus on internally managed solutions can significantly constrain regional or sector focus and result in a limited view of the investment opportunities available in the market. It is important for DC to consider its need to deploy on an ongoing basis, while private markets may not offer up the same number of opportunities year on year.

As many DC LTAFs focus on underlying evergreen structures, we must be careful not to transfer DC’s need for liquidity on to General Partners (GPs), where experience is limited, allowing GPs to focus on what they do best in order to improve member outcomes. This places significant emphasis on the design principles of any private asset solution, to consider the trade-off between longer term returns, risk management and the ability to maintain quality deployment over the life of a DC member.

- Liquidity is best delivered by DC, supported by considered valuation of GPs

FutureWise, and many other platform default solutions, is making a 15% allocation into a private asset LTAF. Let's not forget that this means with DC having 85% in highly liquid assets, the real need for private market liquidity is actually from a public market shock scenario, creating outweighted exposure to private markets (given valuation lag), thereby creating cost and diversification sensitivity.

However unfortunately, private assets are notorious for not offering liquidity in turbulent markets, irrespective of structure and implementation. So the structure of open-ended vs closed-ended does not deal with the liquidity requirements of DC.

Often it can be more helpful for the GP to focus on valuation adjustments rather than providing liquidity during these turbulent market conditions, so that DC isn’t forced to rebalance to maintain strategic asset allocation.

- Treating investors fairly

The best managers will not forego performance fees, nor should DC be pushing these managers for flexibility as it creates outcome alignment. So we are focusing on finding ways to treat DC investors fairly who enter and exit on a daily basis, even considering equalisation charges and

J-curves to ensure investors receive value.Increasingly the more sophisticated DC investors have acknowledged that this challenge must be overcome. The Fidelity LTAF deals with the operational fairness of equalisation and performance fees that are typical for quality closed ended funds and are essential to DC receiving better outcomes amidst complexity.

- Level of external and sector focused implementation

The metamorphosis of DC is yet to complete as it transitions from a ‘cost’ to ‘value’ orientated approach, with the Value for Money framework set to land in 2028.

But the long-term success of private assets will be driven by the rigour of portfolio selection processes and how it applies to both internal and external mandates, with significant risks arising from allocating internally to reduce portfolio manufacture costs.

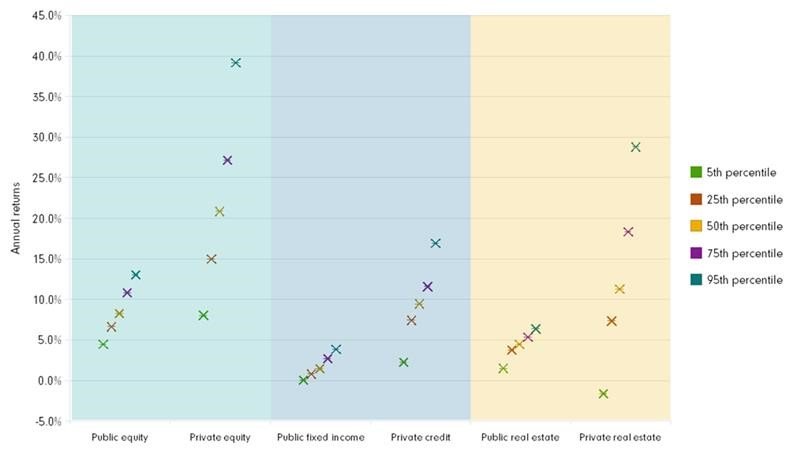

With the distribution of outcomes in private markets being five times larger than public markets as shown in the graph below, the importance of quality selection, data and origination networks is paramount in driving better outcomes.

Source: Blackstone, Morningstar Direct, Preqin. For public assets, annualised returns over the period from 1/1/2017-30/06/2023 (Open-end funds): public equities (US Mid-Cap Blend, US Small Blend); public fixed income (US Intermediate Core Bonds, US Intermediate Core Plus Bonds, US High Yield Bond, US Corporate Bond); public real estate (US Real Estate). For private assets, returns are SI net IRR for 2016 vintages, North America, closed-ended funds: private equity (Buyout), private credit (Direct Lending, Mezzanine, Special Situations/Distressed Debt); private real estate (Debt, Core, Core+, Value Added, Opportunistic).

This argument is further enhanced by Cambridge Associates research, highlighting sector specialists outperform generalists by around 5.7% p.a. to 30 June 2023, illustrating the importance of sector knowledge in deal sourcing, due diligence, data and legals in order to drive long term value.

We are excited to bring these aspects to FutureWise and our Fidelity Diversified Private Asset LTAF and look forward to providing more information in the future.

If you have any questions or wish to find out more, please do reach out to me - james.monk@fil.com - or ask your Relationship Director or usual Fidelity contact.