PlanViewer

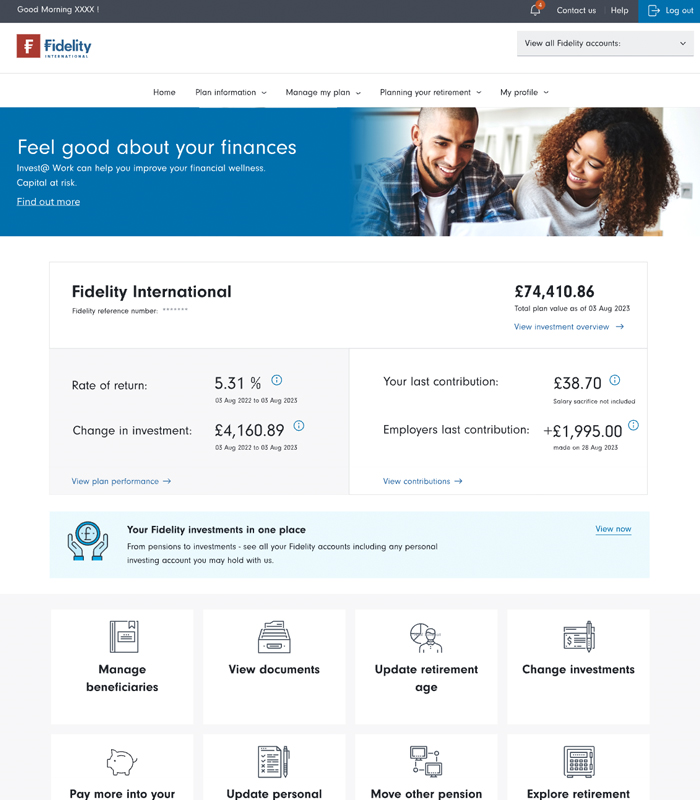

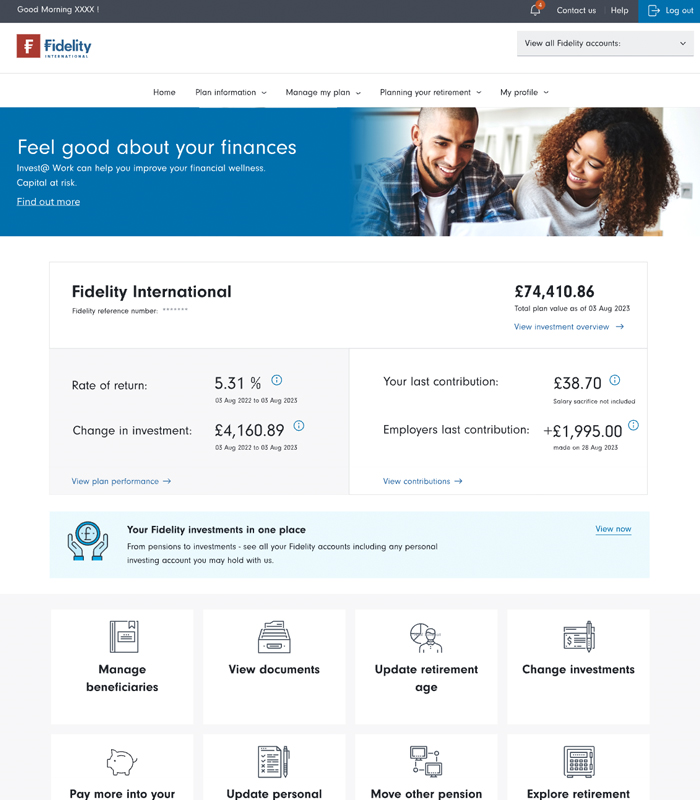

What is PlanViewer?

PlanViewer is our secure mobile online portal where members can access their account and review their workplace savings and plan for retirement, but it offers so much more for your members - enabling them to understand and engage with their workplace savings.

Our short video shows how PlanViewer can help you stay informed and engaged about the scheme. Our range of member videos are designed to help your members to get the most out of PlanViewer.

PlanViewer provides content and nudges tailored to members' life stage with videos, guides, tools/calculators and our retirement hub. Members are taking actions such as completing their ‘expression of wish’ form or updating their retirement age, prompted by the personalised nudges they receive.

Enhancing the member digital experience

We are always enhancing PlanViewer to make it easy to use and of greater value, regularly updating content to reflect the needs of your members. The homepage layout provides clear menus and ‘my investment’ and ‘my retirement’ pages to guide members to the information that they need.

Drawdown information - to support members who have started to take income.

Online withdrawals - Members can now withdraw from their pension online, previously only available over the phone. This online service enhancement is only available for Master Trust and Contract schemes except for Section 32 accounts.

Accessible on the move

PlanViewer is also available as an App and we’ve made improvements to the sign-in process so members can more easily retrieve their username, helping to remove a barrier members can face, without restricting the security.

New My details page - Members can now view their personal details directly in the app, without having to leave the app, with a cleaner layout and improved readability. For members with multiple accounts, the app now identifies this and helps to resolve inconsistencies — ensuring we hold accurate, up-to-date records.

Simplified Retirement Projection Tool - The tool has been streamlined and we’ve introduced promotional cards to guide members who are not eligible to view projections towards other relevant tools, for example members aged over 55 will be directed to the flexible retirement income tool.

Tailored nudges - based on the member lifestage, to provide easy access to relevant articles and messages on birthdays and the anniversary of starting their plan.

PlanViewer Multi Workplace Investing Account - Members can view and manage multiple Workplace Investing Fidelity accounts making it easier to manage all their workplace investments and simplifying the overall experience for onshore clients. Previously, each account had separate login credentials. This is currently only available for UK accounts. This gives members a better overview of their accounts in one place.

Invest@Work - Many clients are also offering Invest@Work which enables employees to access Fidelity ISA accounts from their payroll and other investment accounts including LISA & Investment Accounts with a discount on the usual service fee.

We have carefully considered the member journey in PlanViewer, so it is easy to find the required product and to enhance the overall client experience. We have used the experience and insight we have gained over the years to present members' discount codes clearly with simple account navigation.

Acting on your feedback

We engage with our members and clients regularly and PlanViewer is a key topic area where we look to address any trouble spots and overcome any issues by introducing improvements to make it easier for you and your members.

We are making the administration of your plan easier and providing a better user experience:

- Smoother rehire set up process: New accounts can be set up without the issues/error messages being raised by the system due to the member already having an account. This streamlines the account creation process for rehire members and eliminates unnecessary warnings, ensuring a smoother enrolment process.

- Enhanced reporting: We have added a fund code column to the Plan Holding Position and Plan Valuation for member reports, which helps to reduce errors where a fund may have multiple fund identifcation codes. This helps to streamline the reporting process and reduces the need for manual entry, which can result in errors, improves efficiency in generating bespoke reports, and simplifies auditing processes by providing clear references for fund identification and tracking.

- Single sign on (SSO) rejoiners - The enrolment process for deferred members in SSO enabled schemes has been simplified, allowing you to enrol members without relying on manual issue resolution by Fidelity. For SSO enabled accounts, rejoiners used to get an error message which required manual issue resolution. This update reduces the need for our Service Delivery Managers to address and resolve enrolment issues - leading to a more efficient outcome.

If you have any suggestions for further improvements, please pass your feedback to your Fidelity contact.